colorado employer payroll tax calculator

And if youre in the construction. Tax rates are to range from 075 to 441 for positive-rated employers and from 568 to 1039 for negative-rated employers.

Payroll Tax Calculator For Employers Gusto

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

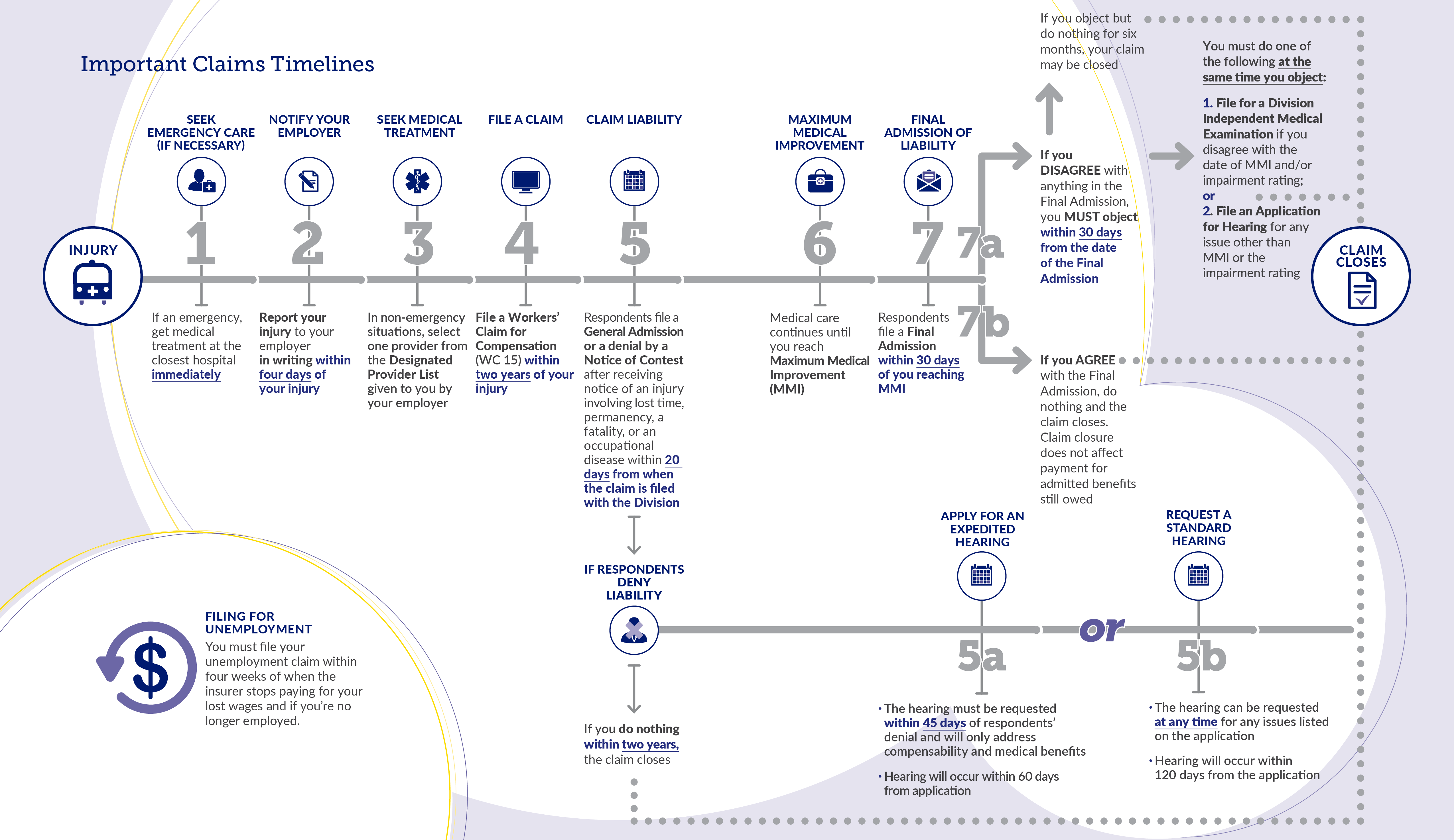

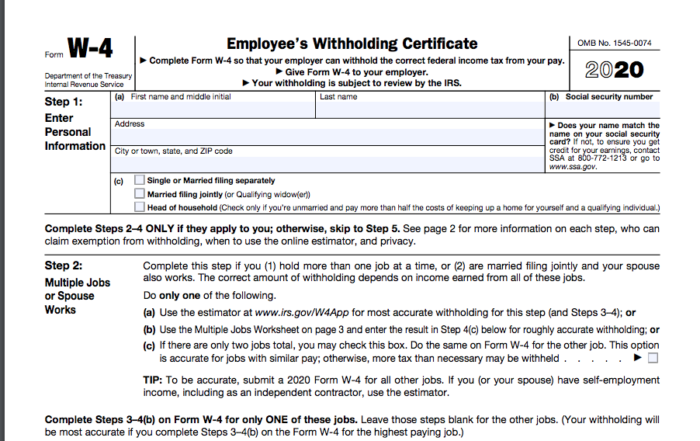

. Any employee who commences employment on or after January 1 2020 must complete the new 2020 IRS Form W-4. Calculating your Colorado state income tax is similar to the steps we listed on our Federal paycheck calculator. Employers are required to file returns and.

DR 0004 Employer Resources. Enter your employment income into the paycheck calculator above to find out how taxes in Colorado USA affect your finances. The Premiums Calculator may save you time and hassle and help ensure you pay the correct amount of unemployment insurance premiums.

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. Calculator Paycheck Calculator 1. There are eight other states with a flat income tax.

Among these states Colorados rate ranks in about the middle of the pack. Account Set-Up Changes. Colorado Paycheck Calculator - SmartAsset SmartAssets Colorado paycheck calculator shows your hourly and salary income after federal state and local taxes.

Colorado Colorado Salary Paycheck Calculator Change state Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Colorado residents only. Simply enter the calendar year your premium.

It changes on a yearly basis and is dependent on many things including wage and industry. The standard FUTA tax rate is 6 so your. Colorado payroll calculators Latest insights The Centennial State has a flat income tax system where the income taxes are relatively low compared to the rest of the country.

The more paychecks you get each year small every paycheck is assuming the same income. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Colorado Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local.

It is not a substitute for the advice. Youll then get your estimated take home pay a detailed. Colorado Unemployment Insurance is complex.

Colorado Paycheck Calculator Use ADPs Colorado Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. California Payroll Tax Withholding Tables 2018. Colorado Unemployment Insurance is complex.

Figure out your filing status work out your adjusted gross. Colorados income tax is also fairly. For any employee who has completed a 2020 IRS Form W-4 the.

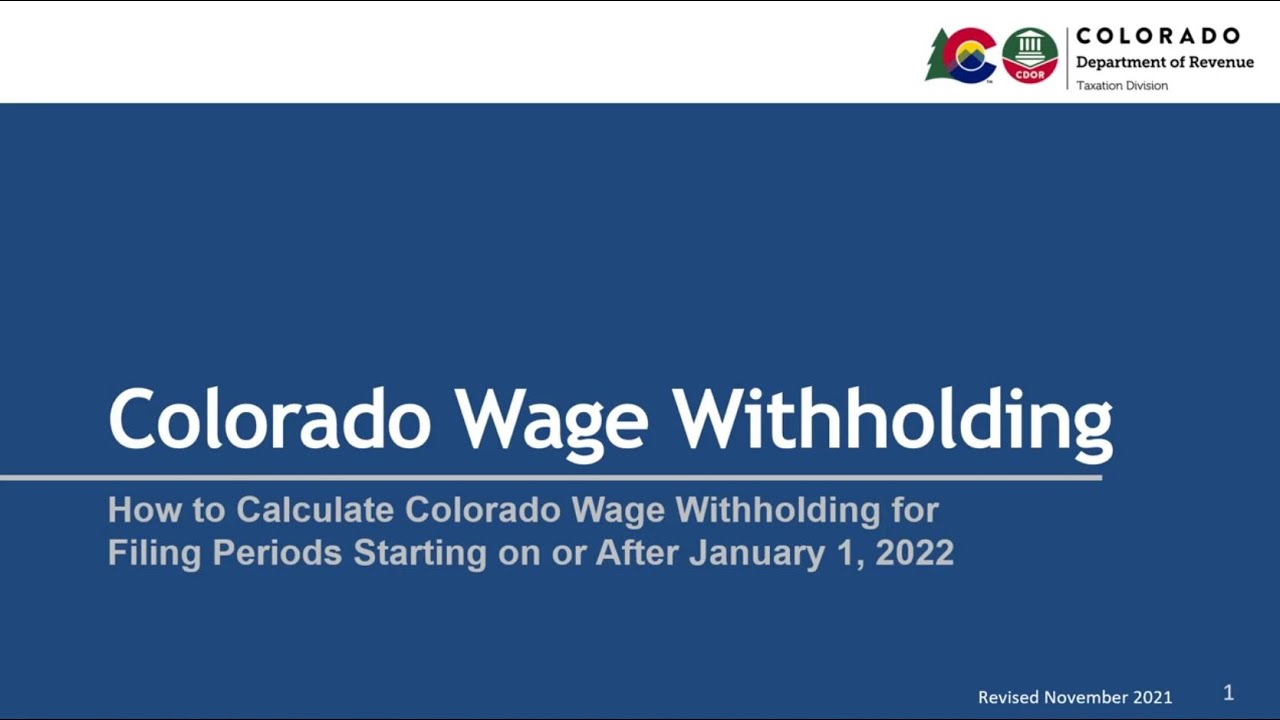

Just enter the wages tax withholdings. The Colorado Withholding Worksheet for Employers DR 1098 prescribes the method for calculating the required amount of withholding. The maximum an employee will pay in 2022 is 911400.

Determine withholdings and deductions for your employees in any state with incfiles simple payroll tax calculator. If you work for yourself an individual need to pay out the self-employment duty which can be.

How To Do Payroll In Excel In 7 Steps Free Template

Nanny Tax Payroll Calculator Gtm Payroll Services

What Are Payroll Taxes And Who Pays Them Tax Foundation

Workers Compensation Department Of Labor Employment

How To Do Payroll In Excel In 7 Steps Free Template

The New Form W 4 Form Is Different Really Different Asap Accounting Payroll

Trump S Proposed Payroll Tax Elimination Itep

What Is The Irs Form 941 Payroll Tax For Employers

Colorado Payroll Tools Tax Rates And Resources Paycheckcity

2021 Calculator Before Covid 19 Relief Kff

Colorado Paycheck Calculator Smartasset

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

W 4 State Withholding Tax Calculation 2020 Based On The State Or State Equivalent Withholding Certificate Sap Blogs

How To Calculate Colorado Wage Withholding Starting January 1 2022 Youtube

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Colorado New Employer Tax Expenses Asap Help Center

Payroll Tax Calculator For Employers Gusto